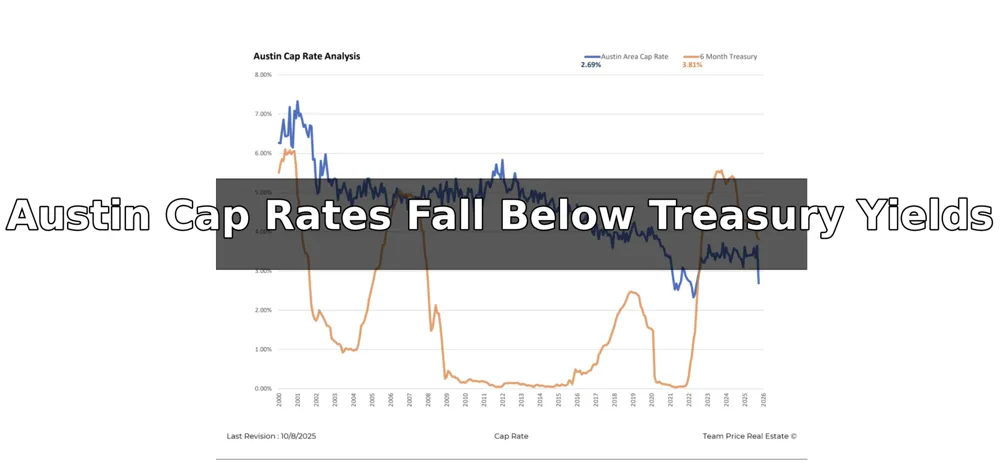

Austin Cap Rate Analysis: October 2025

The Austin investment property market continues to face margin pressure as cap rates remain historically low while short-term yields stay elevated. According to the latest analysis, the Austin Area Cap Rate stands at 2.69%, compared with the 6-Month Treasury yield at 3.81%. This marks one of the few periods in the past two decades where Treasury returns exceed average real estate yields in Austin, reshaping investor behavior and risk profiles.

Cap Rate Trends Over Time

Austin’s cap rates have followed a long-term downward trend since 2000. At the start of the millennium, multifamily and investment property cap rates averaged near 7%, reflecting higher risk premiums and lower property valuations. Through the mid-2000s, rates stabilized around 5%, then declined further during the post-recession recovery period as capital inflows and rising prices compressed yields.

From 2015 through 2021, cap rates in the Austin area consistently hovered between 3% and 4%, underscoring strong investor demand and appreciation-driven returns. The lowest point occurred in late 2021, when rates briefly dropped below 3%, coinciding with rapid rent growth and historically low borrowing costs.

Interest Rate Environment

The 6-Month Treasury rate—currently at 3.81%—has been one of the most influential factors behind today’s investment recalibration. The last time Treasuries exceeded Austin cap rates was in 2000, 2007, and again in 2023–2024, each time corresponding to a tightening in monetary policy or broader market correction. The inversion between short-term yields and property returns often signals capital reallocation toward safer assets and a temporary cooling in real estate acquisition activity.

Implications for Investors

With Austin’s cap rate below the risk-free yield, investors are re-evaluating acquisition thresholds and underwriting models. Cash-flow-based deals have become harder to justify without rental upside or value-add potential. Many investors are shifting toward stabilized assets in strong submarkets where rent growth remains consistent, or exploring development opportunities that offer higher long-term internal rates of return.

At the same time, the persistent strength of the Austin economy—fueled by job growth, population inflows, and corporate relocations—continues to support property fundamentals. This has prevented cap rates from rising sharply, even as financing costs increased. For long-term investors, this suggests the current environment represents a repricing phase rather than a structural decline in market health.

Outlook

If Treasury yields moderate in the coming quarters while property income growth remains steady, cap rates may begin to stabilize or slightly expand toward the 3% range. However, until financing spreads normalize, Austin’s investment landscape will continue to reward disciplined underwriting and local market expertise.