Round Rock New Construction Sees Notable Price Drops: September 24, 2025

The Round Rock new construction market is showing clear signs of adjustment, with 165 active listings on September 24, 2025. Price reductions have emerged across multiple builders and neighborhoods, signaling increased competition and a shifting balance between supply and demand.

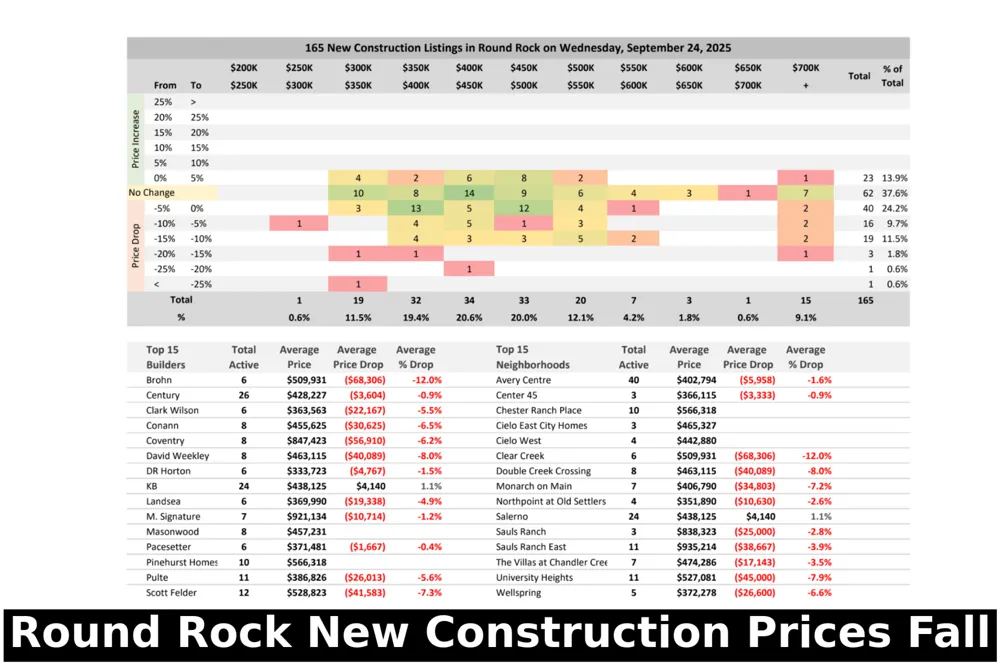

Distribution of Listings and Price Adjustments

Among the 165 listings, the bulk of inventory is concentrated between $300,000 and $450,000. Homes in the $300,000 to $350,000 range represent 19.4 percent of listings, while the $350,000 to $400,000 range accounts for 20.6 percent. Together, these mid-range homes make up more than 40 percent of all available new construction in Round Rock.

The majority of homes have either held steady or seen modest adjustments, but a significant portion shows price reductions. Roughly 24.2 percent of listings fell into the –5% to 0% category, while 9.7 percent saw cuts of –5% to –10%. Another 11.5 percent experienced reductions between –10% and –15%, and smaller groups reported deeper discounts, including a handful with cuts exceeding –20%.

Builder-Level Reductions

Price adjustments are most visible when analyzing builders. Brohn Homes leads the market with an average price drop of $68,306 across six active listings, a reduction of 12.0 percent. David Weekley Homes shows a similar pattern with an average reduction of $40,089, or 8.0 percent.

Scott Felder Homes also reports notable declines, averaging $41,583 off list prices, equal to a 7.3 percent cut. Coventry, Clark Wilson, Pulte, and Conann all register drops between 5 and 8 percent. Century Communities has 26 listings with relatively modest adjustments, averaging $3,604 per home, or a –0.9 percent decrease, while DR Horton remains nearly flat at –1.1 percent.

Neighborhood Impacts

Neighborhood-level analysis reveals parallel trends. Clear Creek stands out with an average decline of 12.0 percent, closely tied to Brohn Homes’ reductions. Double Creek Crossing also reported drops averaging 8.0 percent, while University Heights and Wellspring posted reductions of 7.9 percent and 6.6 percent respectively.

Other neighborhoods showing softer corrections include Chester Ranch Place, Salerno, and The Villas at Chandler Creek, where cuts averaged 3 to 7 percent. By contrast, Avery Centre, the largest concentration of new construction with 40 listings, saw more modest adjustments averaging $5,958, a decline of 1.6 percent.

Market Interpretation

These figures highlight a competitive environment for new construction in Round Rock. Builders with higher inventories are adjusting prices more aggressively, particularly in neighborhoods where absorption is slower. Reductions of 5 to 12 percent suggest that incentives and pricing flexibility are being used to attract buyers in a market that now offers more choices.

For buyers, this represents an opportunity to negotiate further and secure new homes at below-peak prices. For builders, the challenge is to balance pricing strategies with the need to maintain value perception across developments. The concentration of supply in the $300,000 to $450,000 range makes this segment the most contested and therefore the most likely to see continued price pressure.