Weekly Residential Update: A Closer Look at Recent Market Activity

The residential real estate market has shown significant activity over the past few months, as indicated by the latest Weekly Residential Update. This data provides insight into new listings, pending sales, mortgage rates, and open house numbers, allowing us to understand how the market has evolved.

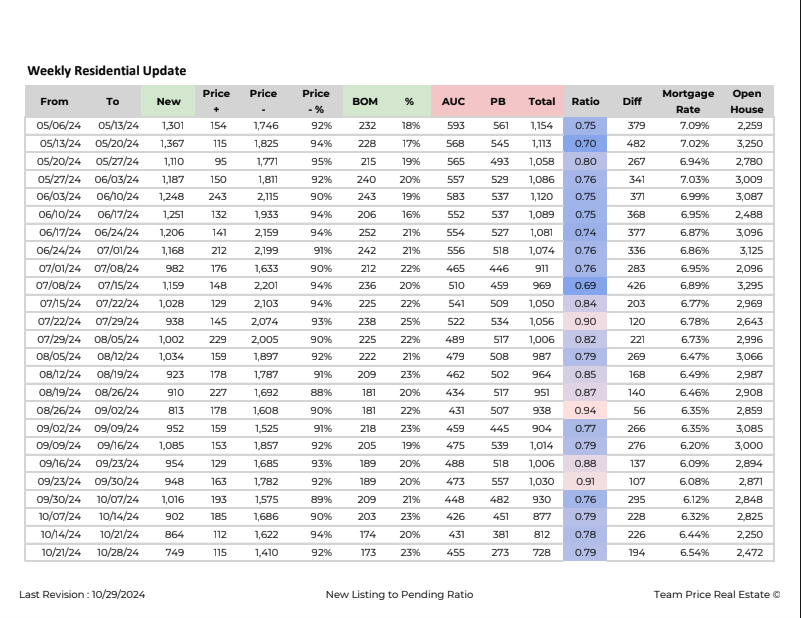

Starting from May 2024, we observe a steady stream of new listings and pending ratios. For instance, during the week from May 6 to May 13, 1,301 new properties entered the market, with 154 price adjustments and a pending sales count of 1,746. The back-on-market (BOM) rate was 92%, and the average percentage of properties under contract (AUC) was 18%. During this time, the mortgage rate stood at 7.09%, and the market saw 2,259 open houses.

Moving further into the data, by the week of June 3 to June 10, new listings increased slightly to 1,248, while price changes reached 243. The pending sales count peaked at 2,115, showing that the market was seeing an upswing in buyer interest. The BOM rate during this period remained steady at 90%, while the AUC was 19%, showing a consistent rate of sales activity. The mortgage rate slightly decreased to 6.99%, potentially encouraging more buyers to explore their options.

Throughout July 2024, the market showed more notable changes. During the week of July 8 to July 15, new listings slightly dropped to 1,159, with 148 price adjustments. This week had one of the lowest pending ratios in the dataset, with a pending sales count of 2,201, reflecting a slower pace in the market. The mortgage rate for this period was 6.89%, which might have influenced buyer activity.

One of the highest ratios recorded was from August 19 to August 26, where the pending ratio reached 0.87. During this time, 910 new listings were recorded, with 227 properties undergoing price changes, and a high pending sales count of 1,692. This week stood out as a period of intensified market activity, with a relatively lower mortgage rate of 6.49%. Additionally, there were 2,908 open houses during this time, suggesting a strong level of buyer interest in viewing properties.

As we look closer at the fall season, the trend shows some slowing in both new listings and pending ratios. For example, from September 30 to October 7, the pending ratio was 0.76, with 1,016 new listings and 193 price changes. The pending sales count was 1,575, and the mortgage rate slightly rose to 6.95%, which may have influenced a more cautious buyer market.

Most recently, during the week of October 21 to October 28, new listings dropped to 749, marking one of the lowest counts in recent months. The pending ratio was 0.79, with a pending sales count of 1,420. With the mortgage rate at 6.54%, we may see additional adjustments in buyer behavior moving forward.

Overall, this data reveals the trends in the residential real estate market over recent months. From changes in new listings and price adjustments to shifts in mortgage rates and pending ratios, this report captures the dynamic nature of the housing market. Each week brings unique fluctuations, providing valuable insights for those watching market trends or considering entering the real estate market.